The sticker price rarely reflects your final bill, and Secureframe pricing plans are no exception. If you are evaluating Secureframe this year, you cannot stop at the quoted subscription.

You need clarity on the real costs, including plan differences, hidden add-ons, renewal increases, and audit fees that are often not disclosed. You also need to know how long it takes before ROI is visible.

This article brings together verified pricing ranges, real cost analysis, and common negotiation tactics so you can understand how much Secureframe actually costs.

The goal is to help you make a clear decision about whether Secureframe is worth the investment for your frameworks and business stage or you must consider an alternative platform within your budget.

Quick Summary: Secureframe pricing at a glance

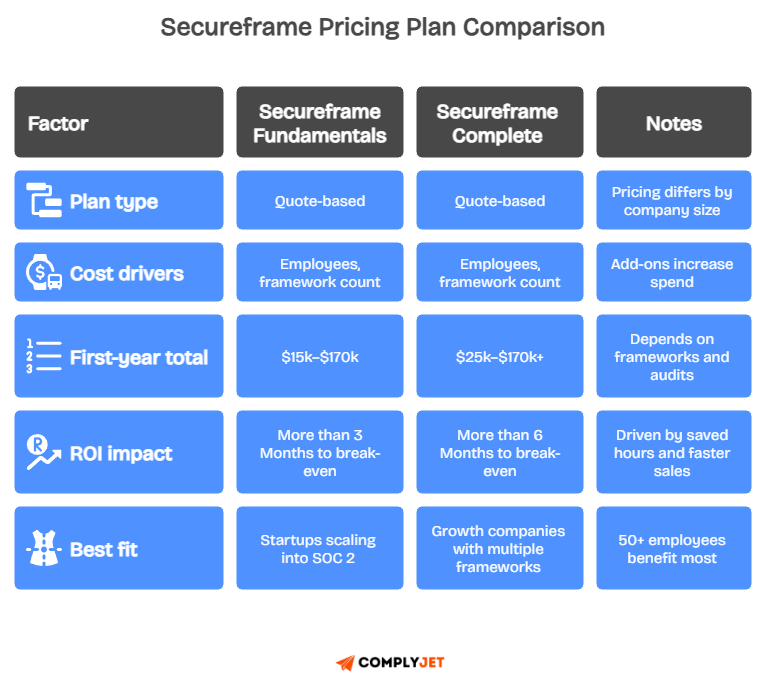

Before you dive into the details, it helps to see the Secureframe pricing model summarized. Two plans with several drivers shape what you actually pay.

The Fundamentals Secureframe pricing plan targets smaller teams with a single compliance framework, while the Complete plan adds advanced features for larger or more complex organizations. Both are sold through quote-based pricing.

What really drives Secureframe's cost is not the plan alone, but rather the number of employees you have, the number of frameworks you need, the number of workspaces, and your support tier selection.

For most teams, the typical Secureframe pricing for 1 year usually falls between $7,500 – $15,000 for very small teams, $20,000 – $45,000 for growth-stage, and $60,000 – $100,000+ for mid-market enterprises.

Secureframe is generally a better fit for companies with 50 or more employees or those building multi-framework roadmaps. Smaller teams can see value, but the price-to-utility ratio improves as your compliance needs grow.

This high-level summary gives you the pricing context. Now let's get into the details.

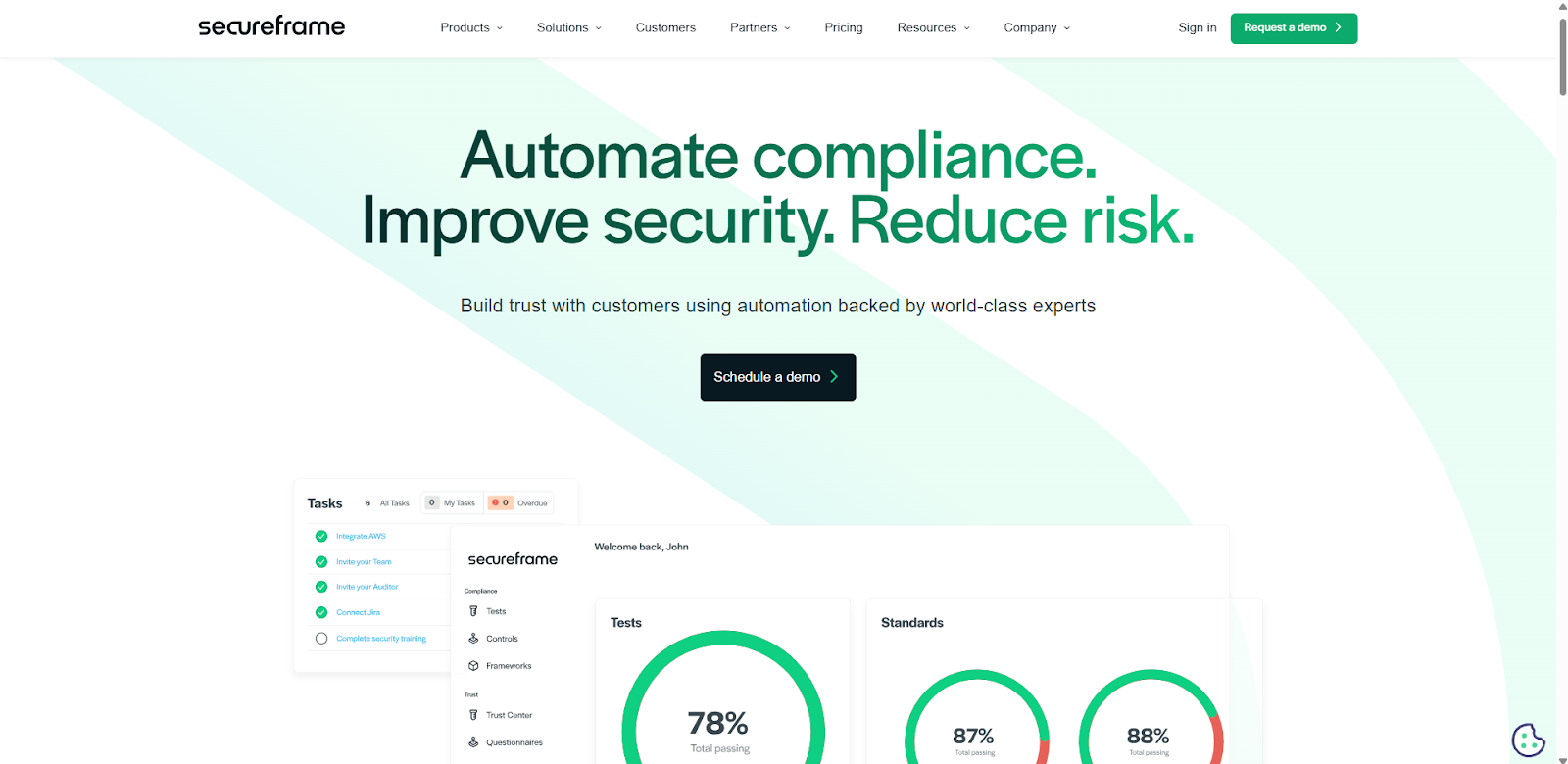

What is Secureframe and What does it do?

You use Secureframe to automate compliance work for SOC 2, ISO 27001, and HIPAA. It centralizes controls, collects evidence, and keeps you audit-ready with continuous checks.

Secureframe reduces screenshots and manual trackers; it connects to your stack, monitors changes, and prepares clean artifacts for auditors and customer security reviews.

You get guided workflows and clear ownership across teams, which helps you finish compliance tasks faster, without building heavy internal processes from scratch.

This is useful when sales ask for a trust center and third-party questionnaires; you can answer quickly and keep momentum in active deals.

Who uses Secureframe?

SaaS teams use Secureframe to unlock SOC 2 quickly, healthtech teams align with HIPAA, and fintech teams strengthen controls for enterprise contracts and banking partners.

Enterprise B2B companies standardize multi-framework programs across subsidiaries; they reuse controls, scope assets, and coordinate audits on one platform.

Founders and security leads value fewer consultant hours and clearer timelines; sales leaders appreciate shorter questionnaire cycles and faster approvals.

Smaller teams still benefit, but value rises as frameworks and stakeholders increase across the company.

Secureframe Features

Secureframe features include evidence automation, policy drafting and publishing, a risk register with assessments, vendor risk workflows, a public trust center, 300+ integrations, and AI assists for remediation and questionnaire responses.

Evidence automation pulls config from AWS, GCP, Azure, Okta, and GitHub. This replaces screenshots and reduces repeat work across frameworks.

AI assists help you draft policies, fill security questionnaires, and respond to findings faster. You keep control, but start with stronger first drafts.

The trust center publishes real-time posture and reports, which shortens security reviews and builds buyer confidence during enterprise procurement.

How do they help?

With the purpose clear, review the Secureframe pricing model in 2025, then map features to the plan that fits your scope and budget.

Secureframe pricing model in 2025

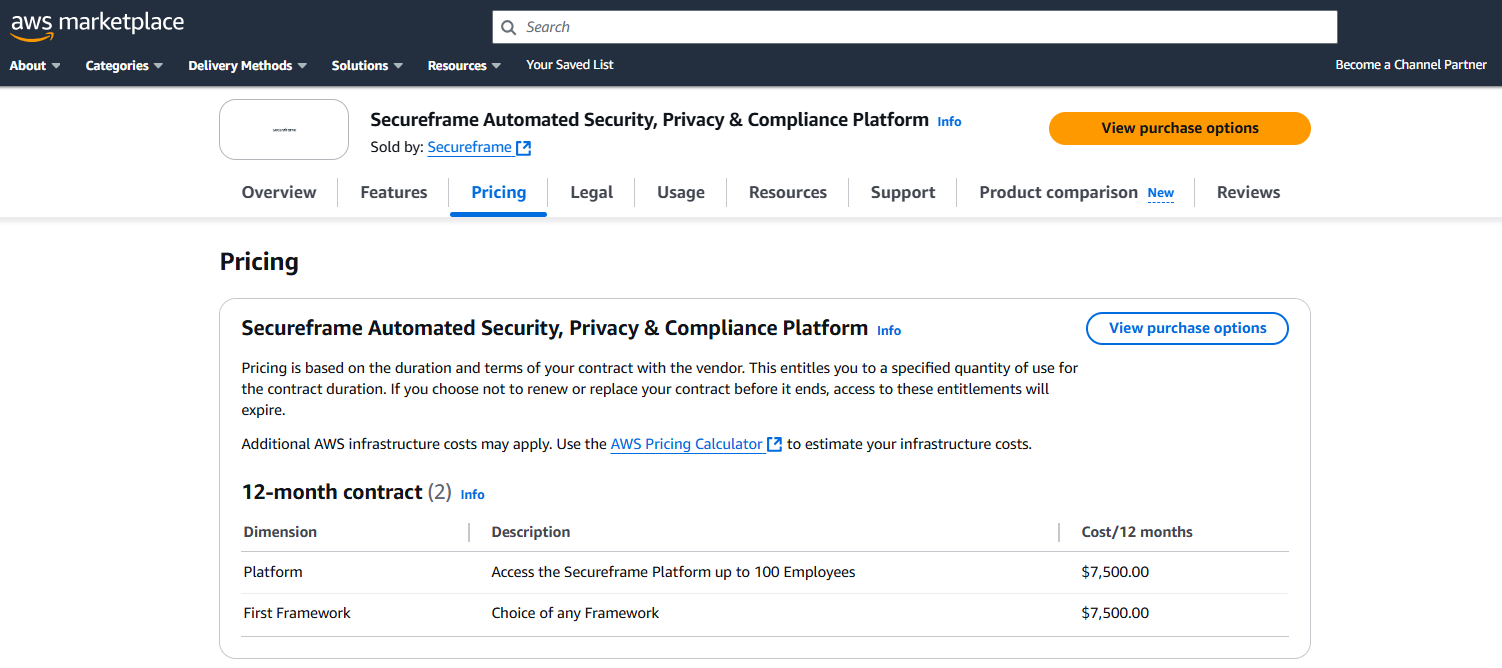

Secureframe pricing is quote-based and starts from $7,500/year with two plans called Fundamentals and Complete, and your Secureframe price changes with headcount, framework count, enabled features, workspaces, and the contract term you choose.

Add-ons matter because each additional framework is also commonly quoted around $7,500, and extra workspaces or premium support appear as separate line items, which affects your real pricing at renewal.

Secureframe Packages

Among the two packages Secureframe offers, the fundamentals plan targets startups with one framework and a limited number of automated tests, covering core evidence automation, basic questionnaire automation, standard vendor risk, and a standard trust center suitable for early sales motions.

Complete plan targets teams that need more automation and control, including unlimited automated tests, SSO and SCIM, advanced questionnaire automation, advanced vendor risk, and advanced trust center features for enterprise procurement.

Workspaces let you separate subsidiaries or environments, which helps multi-product companies control scope and ownership, and pricing for extra workspaces is quote-based within the Secureframe packages conversation.

Both plans support 300-plus integrations and AI assists, so you expand automation by enabling more connectors across your stack, improving Secureframe ROI as your evidence sources increase.

What changes your final Secureframe pricing?

Price steps up by employee band, frameworks, and selected modules, so larger teams and multi-framework roadmaps receive higher quotes than single-framework startups, considering Secureframe prices for the first time.

Contract term and timing influence discounts, since longer terms often reduce unit price, and aligning to quarter end can improve commercial terms, which helps your Secureframe cost fit the budget constraints.

Implementation scope also matters because deeper integration coverage increases value and can raise quotes due to added modules and support expectations in the SecureFrame pricing model.

Map these levers to your roadmap before negotiating, so your Secureframe pricing aligns with the required outcomes instead of optional extras, which keeps your spend efficient.

Next, review real Secureframe prices by company size and typical first-year totals, so you can budget with confidence and compare against your expected ROI.

Secureframe real pricing by company size

You want clear, Secureframe pricing by size. Start with headcount bands because quotes track people, integrations, and support needs. Bigger teams and more frameworks raise the annual platform price.

Use these ranges to set a working budget, then adjust for frameworks and add-ons. Expect quotes to center in the middle of each band, with outliers at both ends.

Plan for a per-framework add-on on top of the platform price. Add audit costs separately, since audits are external and not covered by the subscription.

Average deal values near $20,500. The most common add-on is ~$7,500 per additional framework, which pushes total Secureframe prices when you add ISO or HIPAA.

Typical Secureframe pricing range by employee count:

Simple steps to estimate

- Select your headcount band to anchor the platform range.

- Add ~$7,500 for each extra framework beyond the first.

- Include audits separately for each framework.

- Adjust for workspaces or premium support if required.

With size-based pricing clear, move to framework-specific Secureframe pricing, so you can connect platform scope, audit fees, and timelines to your exact certification plan.

Framework-specific pricing guide: SOC 2, HIPAA, ISO 27001

You pay Secureframe for automation and workflows, and you pay auditors or assessors separately. Keep these buckets separate so your Secureframe pricing and ROI math stay accurate.

Add one framework at a time if the budget is tight. Expand when sales demands increase. This phased approach keeps spending predictable and focused on near-term outcomes.

Use the steps below to map cost drivers for SOC 2, ISO 27001, and HIPAA. Then layer audit fees and internal time to build a full-year budget.

Keep timelines realistic. Readiness windows depend on team availability, gaps, and integration coverage across cloud, code, and devices.

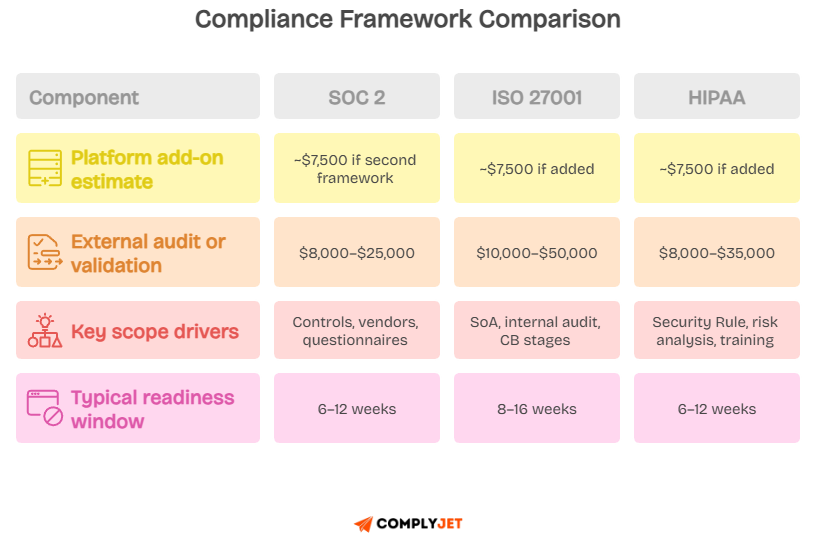

Secureframe SOC 2 pricing and cost drivers

Start with the platform scope. Include evidence automation, policy mapping, vendor reviews, and questionnaire automation. If SOC 2 is your second framework, add ~$7,500 to your platform price.

Set audit fees outside the platform. Typical SOC 2 audit costs range from $8,000 to $25,000, depending on Type 1 or Type 2, observation period, and selected audit firm.

Plan readiness time. Focused startups often reach readiness in 6 to 12 weeks. Larger teams with more vendors may need extra time to close gaps and collect evidence.

But with ComplyJet, you can get audit-ready in just 7 days for under $4999/year. Yes, it’s true. We’re a lean team and we make it happen.

To know more, Talk to our Founders!

Trim internal time. Connect integrations early, assign clear control owners, and pre-answer common questionnaires to shorten review cycles and reduce consulting spend.

Secureframe ISO 27001 pricing

Scope the ISO program. Include Statement of Applicability, internal audit planning, risk treatment, and evidence mapping. If adding ISO to SOC 2, budget ~$7,500 as a platform add-on.

Price certification audits separately. Certification bodies often total $10,000 to $50,000 across Stage 1, Stage 2, and surveillance cycles. Ask about day rates and travel.

Set timelines. Many teams target 8 to 16 weeks to establish the ISMS baseline and pass Stage 1, then complete Stage 2 after addressing findings.

Reduce friction. Reuse SOC 2 controls where applicable, align policies to Annex A, and schedule internal audits early to avoid delays before Stage 2.

Secureframe HIPAA pricing

Focus on the Security Rule. Plan recurring risk analysis, role-based training, and technical safeguards because adding HIPAA to SOC 2, budget ~$7,500 as a platform add-on.

Handle external costs. HIPAA assessment or validation often ranges $8,000 to $35,000, depending on scope, environment complexity, and assessor requirements.

Schedule risk analysis at least annually, refresh BAAs, and log workforce training. These steps help sustain compliance during growth.

Drive adoption and map safeguards to actual systems, track exceptions, and keep a simple issues register. Smaller, frequent updates beat large, infrequent changes.

Read: HIPAA Compliance Automation Tools

With framework costs set, you can combine size-based ranges and audit fees to produce a first-year total for your team.

True total cost of ownership & Hidden Costs

Secureframe pricing excludes several items, so add them to your budget early. External audits typically cost $8,000 to $50,000 per framework, depending on scope and selected firm.

Budget pentests at $5,000 to $20,000 per test, based on coverage and methodology, since penetration testing is not bundled into Secureframe prices for most quotes.

Account for internal time worth $5,000 to $15,000 in setup effort, plus ~$7,500 per additional framework, premium support, and extra workspaces, which are usually quote-based.

Keep platform and non-platform buckets separate, so your SecureFrame pricing model remains clear for approvals and renewal planning across finance and security.

Renewal pattern you should expect

Plan for 5 to 15 percent annual increases if you do nothing, since standard renewals often include uplift. Use caps and price locks during initial negotiation.

Watch for auto-renewal notice windows, often 30 to 60 days, which can lock you into uplifts. Calendar these dates at signing to preserve leverage.

Review ramp clauses that grow seats or modules over time, because these increase Secureframe cost without a new competitive event. Remove non-essential ramps.

Ask for multi-year price protection with clear increase caps, so your pricing stays predictable across years two and three.

With hidden costs and TCO mapped, you can run the numbers confidently. Next, convert savings and timelines into a Secureframe ROI analysis using simple inputs and clear formulas.

Secureframe ROI analysis: the math that matters

Secureframe ROI improves when automation replaces screenshots and spreadsheets, because labor hours fall sharply and audit prep gets simpler for SOC 2, ISO 27001, and HIPAA.

Across customer data, payback often lands inside 6 months, which beats typical compliance software timelines. First-year returns commonly reach two hundred to four hundred percent.

The pricing becomes credible when tied to observed hours saved, shorter questionnaires, and fewer billable auditor hours, not just a platform quote or a generic benchmark.

In 2025, the Secureframe pricing model favors teams running multiple frameworks, since shared controls reuse evidence across audits, amplifying savings without multiplying effort.

Where different sizes actually land

Small teams of nearly fifty people often see a platform in the $14,000/year to $20,000/year range, and hit payback in 3 to 6 months once core integrations are live.

Mid-market companies with around two hundred employees usually price in the thirties, then compress payback to three to five months as questionnaire automation compounds savings.

Enterprises with five hundred employees justify sixty to one hundred thousand, recover more than three hundred thousand in labor, and often reach payback within one quarter.

Outliers track adoption depth. Full coverage shortens timelines and strengthens Secureframe ROI, while shallow usage delays benefits and makes Secureframe pricing feel heavier.

What actually creates the return

Time savings drive most of the outcome. Evidence automation and clean exports reclaim thousands of hours across security, engineering, and audit coordination. That powers Secureframe ROI.

Revenue acceleration matters for sales-led teams. A live trust center and reusable questionnaire answers cut review time by weeks, making Secureframe pricing easier to defend.

Risk reduction compounds over the years. Continuous monitoring lowers repeat findings and unplanned fixes, which rarely appear in quotes but always appear in budgets.

When these streams stack, the Secureframe pricing model feels small relative to recovered hours and pulled-forward revenue, which is why payback in 2025 often arrives quickly.

If your environment can convert integrations into hours saved and faster questionnaires, Secureframe pricing becomes a lever, and the ROI math holds under finance review.

Is Secureframe worth it? A simple decision framework

You will see strong value from Secureframe when you have 50+ employees, pursue multiple frameworks, sell to enterprise, and have a thin internal compliance bench that needs automation.

If you are under 20 employees with a single framework and a simple scope, consider a phased approach or lighter tools, since your Secureframe cost-to-benefit may be lower today.

This is when a platform like ComplyJet can benefit you immensely. We offer multiple frameworks for under $7999/year, which exactly suits your budget.

Still unsure? Start our FREE TRIAL to know more!

Practical signals to decide

Green light when sales require a trust center, security questionnaires stall deals, and you plan SOC 2 plus ISO or HIPAA within twelve months, since multi-framework leverage increases Secureframe ROI.

Should you invest?

If your signals trend green, move to negotiation. The next section shows how to improve Secureframe pricing in 2025 terms without sacrificing scope or timelines.

Negotiating Secureframe pricing: proven strategies

If you want to sign a fair deal, approach negotiation with these simple levers, clear asks, and written guardrails that keep renewals predictable as your program scales.

Timing that improves leverage

Close near quarter-end or year-end to unlock stronger discounts. Extend to multi-year when budget allows, since longer terms often trade for better secureframe prices and price protection.

Packaging that lowers TCO

Bundle multiple frameworks in one order to reduce per-framework add-ons, request a renewal cap, and lock pricing for two to three years to stabilize your secureframe cost curve.

Competitive leverage that works

Bring alternative quotes from Vanta or Drata, ask for a pilot to prove outcomes, and request startup concessions if you are under fifty employees, especially during growth conversations.

Typical discount bands

Standard buyers land 10–20 percent off list. Strategic buyers see 20–35 percent with multi-year, multi-framework, and timing alignment, which materially improves secureframe pricing 2025 budgets.

Before you sign: clauses to negotiate

With timing, packaging, and leverage aligned, your Secureframe pricing should reflect real value. Next, finalize internal approvals using your ROI worksheet and payback checkpoints.

Secureframe reviews and user feedback on price-to-value

Most Secureframe reviews say price feels fair when onboarding is structured, support is responsive, and integrations remove screenshots, because questionnaire automation shortens security reviews and helps revenue teams move faster.

Reddit threads share starters near $7,500 for small teams, about $7,500 per added framework, and renewal uplifts of 5 to 15 percent unless caps are negotiated and written into the first contract.

What happy customers share

Happy buyers connect cloud, code, and identity early, publish a trust center, and track hours saved, so price-to-value improves as questionnaires drop from days to hours and audits become predictable.

What unhappy customers share

Unhappy buyers report unclear add-ons like workspaces or premium support, late renewal surprises, or single-framework scope at very small sizes, where the platform can feel expensive relative to usage.

Here’s a verified review of a Mid-market CEO on Retail with 51 - 100 employees from G2,

Anonymized snippets:

Use these patterns to benchmark your quote.

To make an informed decision, read: Detailed Secureframe Review & Alternatives

What ComplyJet does differently?

You want predictable outcomes and honest math to make a decision.

ComplyJet gives it to you directly by keeping prices transparent, tying scope to outcomes, and helping you compare the prices to Secureframe without guesswork or hidden add-ons.

Transparent pricing and real readiness

You see bundled prices for first-time SOC 2, ISO 27001, and HIPAA, with listed add-ons and capped renewals. You also get a 7-day readiness playbook tailored for small teams.

Get audit-ready in just 7 days!

White-glove support when you stall

You can move faster with ComplyJet because we join working sessions, assign owners, and write with you. When you get stuck, founder-led support unblocks decisions instead of routing you through ticket queues.

Cross-framework mapping and audit partners

You can reuse controls across SOC 2, ISO, and HIPAA, reducing duplicate evidence. Our audit network provides predictable fees and dates, so scheduling does not derail quarter goals.

AI tuned for lean teams

You draft policies, answer questionnaires, and triage risks with AI that mirrors lean workflows. Results stay editable and auditor-friendly, so you keep speed without losing control.

Now you can decide for yourself with differences clearly explained.

FAQs

Does Secureframe include auditor or penetration testing fees in its price?

No. Secureframe pricing covers the compliance automation platform, not third parties. SOC 2 audit engagements, ISO 27001 certification bodies, HIPAA assessments, and pentests are separate supplier contracts.

Real buyers report audit totals between $8,000 and $50,000 depending on scope, and pentests around $5,000 to $20,000.

Treat these as part of your total compliance cost, then judge Secureframe ROI on hours saved and revenue unblocked rather than expecting those external bills to disappear.

Can startups under 20 employees get Secureframe discounts or flexible terms?

Often, yes. Small teams frequently see starter quotes near $7,500 for a single framework, and some win softer renewal terms when they disclose runway limits and narrow scope. The tradeoff is feature depth and add-ons.

If you are early stage, the value case improves when questionnaires arrive often or enterprise prospects demand an audit date, because the same platform cost now protects near-term revenue and strengthens the Secureframe pricing story to finance.

Do Secureframe prices increase at renewal, and how do I cap them?

Renewal uplifts are common in the category, with buyers citing 5 to 15 percent absent protections. Long term value comes from predictability. Teams that publish a renewal ceiling, list add-on rates, and avoid automatic rollovers tend to report steadier budgets and cleaner Secureframe ROI year two and year three.

The platform’s return usually compounds as more controls and questionnaires move through automation, so avoiding surprise increases preserves that compounding effect.

What are the common Secureframe hidden costs new buyers overlook?

The headline subscription excludes audits and pentests, which are the largest non-platform items. New buyers also underestimate the ~$7,500 per-framework add-on when they expand from SOC 2 to ISO 27001 or HIPAA, and some discover premium support or extra workspaces priced separately.

Internal time is the sleeper cost. Even with automation, owners still review policies, close gaps, and answer follow-ups, so the smartest Secureframe pricing comparisons include those hours alongside the platform.

How many integrations are included before add-on fees kick in?

Most high-volume integrations are available in base plans, which is why users highlight reduced screenshots and cleaner exports. Add-on pricing shows up when you enter advanced modules or need workspace-specific connectors at scale. Coverage matters more than raw counts. The ROI engine is evidence pulled automatically from your actual stack. The broader that coverage, the stronger your case that Secureframe pricing converts into measurable time saved.

Can I pause my Secureframe subscription between audits to save cost?

Practically, teams keep subscriptions active year round because questionnaires, vendor reviews, and trust center updates do not pause between audits. Continuous monitoring also reduces the scramble before surveillance or Type II periods.

The financial lens is opportunity cost. If security questionnaires arrive every month, the carry of an annual Secureframe price is usually smaller than the friction cost of going dark and restarting your posture later.

How does Secureframe handle multiple subsidiaries or workspaces, and does that affect price?

Workspaces carve up entities, products, and environments, which improves scoping and evidence hygiene for complex orgs.

Buyers like the governance, but extra workspaces can appear as quoted items, so total Secureframe prices vary by structure even when headcount is similar.

Multi-entity teams often report better audit experiences because sampling and ownership are clearer, which subtly strengthens the Secureframe ROI case despite the higher platform line.

What are typical Secureframe implementation timelines for SOC 2 vs ISO 27001 vs HIPAA?

Realistic readiness windows cluster around 6–12 weeks for SOC 2, 8–16 weeks for ISO 27001 due to Statement of Applicability and internal audit planning, and 6–12 weeks for HIPAA. The spread reflects integration depth and gap closure, not just tool setup. Where timelines compress, it is usually because identity, cloud, and code repositories are connected early and evidence flows automatically, which is where Secureframe pricing tends to feel justified.

How does Secureframe pricing compare for a single framework versus two or more frameworks?

Single-framework buyers pay the platform fee aimed at one certification path. Adding ISO 27001 or HIPAA commonly adds about $7,500 per framework. The effective price per framework often improves as you stack frameworks because controls, evidence, and training overlap. That shared-controls effect is the reason multi-framework roadmaps often report stronger Secureframe ROI than one-and-done programs.

What negotiation strategies actually worked for buyers in 2025?

Patterns are consistent. Quarter-end or Q4 closes created 10–20 percent room, and multi-year commitments added another 10–15 percent. Competitive quotes from Vanta or Drata helped align scope and price. Where outcomes were clearest, buyers also secured price protection and published add-on schedules, which made year-two Secureframe prices more predictable and the business case easier to renew.

What is Secureframe’s valuation and funding history, and does it affect pricing strategy?

Funding sets ambition and feature velocity, but your quote still reflects scope drivers like employee band, framework count, workspaces, and support needs. The practical signal is market traction. Strong adoption in mid-market and enterprise tends to stabilize category pricing, while individual Secureframe pricing outcomes hinge on your use case and timing rather than headline valuations.

Is Secureframe worth it if I only need a trust center and basic questionnaires?

Sometimes. If security questionnaires arrive weekly and prospects expect a live trust center, the subscription often returns value quickly because it removes a real sales blocker.

If volume is low and you only carry one framework, the math can be tighter. Many teams compare lighter alternatives for year one, then revisit Secureframe pricing when questionnaire volume or multi-framework plans make automation pay for itself.

Conclusion

A quote tells you the subscription, not the outcome. Frame Secureframe pricing against hours saved, deals accelerated with audits that land on time, then decide if the payback window fits your plan.

If your pipeline is enterprise and frameworks stack quickly, the premium can make sense. Deep integrations, a live trust center, and tight onboarding turn price into measurable ROI.

If you are early, simplicity wins. Start lean, cap renewals, and list add-ons in writing. Revisit multi-framework automation when questionnaires and audits begin to block revenue.

Negotiate like finance will read the order form later. Lock price protection, remove auto-renew, and bundle frameworks. You want predictability in year two as much as savings today.

Want a cleaner first step before a big commitment?

Start a ComplyJet free trial, see transparent pricing, and then compare outcomes side by side with your Secureframe quote.